The Institute on Taxation and Economic Policy

What's New

Trump Administration Provides Biggest Illegal Tax Cuts Yet for Billion-Dollar Corporations

February 20, 2026 • By Amy Hanauer

The Treasury Department is unilaterally cutting corporate taxes with regulations that ignore the statute they claim to implement, disregarding the separation of powers between the branches of government that has defined how America works for more than two centuries.

Property Tax Reforms Can Bring Racial Justice

February 19, 2026 • By Brakeyshia Samms

Homes in Black neighborhoods are more likely to be over-assessed for tax purposes while being undervalued by private appraisers.

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

States often link their tax laws to the federal code in significant ways. Many of these links are justified and can simplify tax administration for both taxpayers and state officials. But in other cases, something can get lost in translation, and states end up copying federal provisions that just don’t…

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own…

Palantir Pays Zero Federal Income Tax Despite Explosive Growth, Largely Due to Trump Tax Law

February 17, 2026 • By Matthew Gardner

Palantir reported $1.5 billion of U.S. income but paid exactly zero federal income tax in 2025. Despite explosive growth, tax breaks from the Trump tax law helped Palantir avoid paying even a dime of federal income tax on its earnings.

ITEP in the News

Audio: ITEP's Kamolika Das on the Need for States to Raise Revenue in the Wake of 2025 Trump Tax Law

Business Insider: Mamdani Says if the State Won’t Tax the Wealthiest New Yorkers, He’d Have To Tax the Middle Class as a ‘Last Resort’

KCUR: Eliminating Missouri’s Income Tax Could Actually Cost You More — Unless You’re Rich

Thomson Reuters: OBBB Put Pressure on States to Raise Revenues, Analysts Say

The Hill: Want ‘Affordability?’ Start by Retooling Your State’s Regressive Tax System.

ITEP Work in Action

Massachusetts Budget & Policy Center: Testimony Regarding an Act To Manage Federal Tax Changes in Massachusetts

Economic Policy Institute: Everything You Need To Know About “No Tax on Overtime”

The Cascadia Advocate: Five More Claims Against the Million-Dollar Earners’ Tax That Don’t Check Out: Debunking Republicans’ Opposition to SB 6346

Mackinac Center: Lawmakers Should Reject Sales Tax Holidays

Economic Policy Institute: Everything You Need To Know About “No Tax on Tips”

Across the States

Tax Watch

State Tax Watch 2026

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Get weekly updates by signing up for our State Rundown newsletter.

Learn more about state taxes across the country, read Who Pays?

State Rundown & On the Map

On the Map

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS…

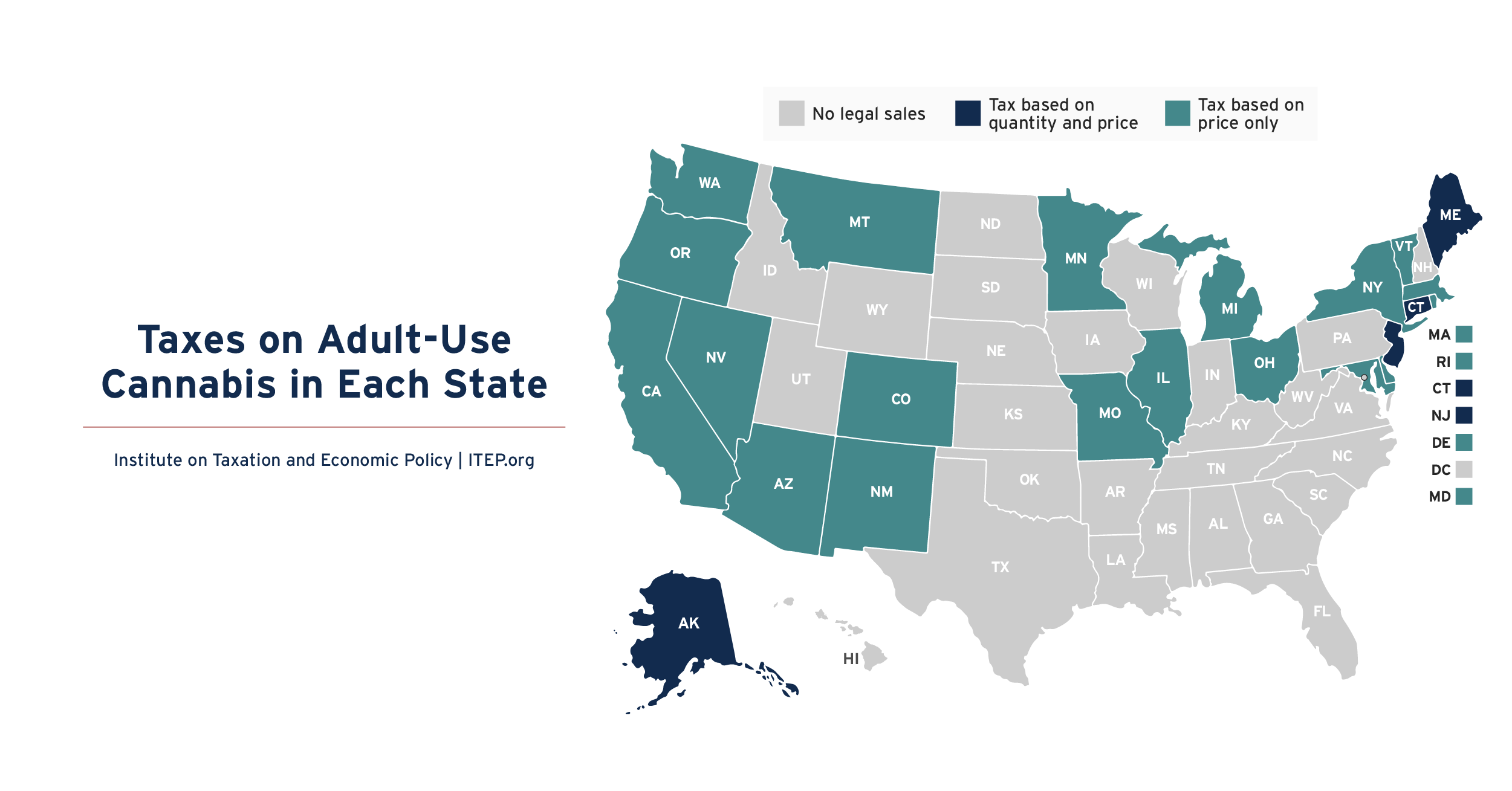

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

State & Local Tax Policy

Property Tax Reforms Can Bring Racial Justice

February 19, 2026 • By Brakeyshia Samms

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

Michigan Ballot Proposal Would Boost Public Education While Creating a Fairer Tax System

February 17, 2026 • By Matthew Gardner, Miles Trinidad

NCTI is an Important Part of the Federal Corporate Tax. States Should Adopt It Too.

February 12, 2026 • By Carl Davis